Understanding the Importance of Accounting for Financial Services

In today's fast-paced business environment, the need for accurate and reliable financial information has never been more critical. Accounting for financial services is a specialized field that involves managing and reporting financial transactions for a variety of organizations within the financial industry. This article delves deeply into the nuances of this crucial area, highlighting its significance, challenges, and the role of accountants and business consultants in ensuring the success of financial service entities.

The Foundation of Financial Services

Financial services encompass a broad range of activities, including banking, investment management, insurance, and real estate. Each sector has its unique financial requirements, regulatory frameworks, and economic influences. To effectively navigate these complexities, solid accounting practices are essential. Here’s a breakdown of the primary areas where accounting plays a vital role:

- Transaction Recording: Financial services involve high volumes of transactions daily, necessitating accurate and timely recording to provide a clear financial picture.

- Regulatory Compliance: Compliance with financial regulations is paramount. Accountants ensure that organizations adhere to laws and standards that govern financial reporting.

- Financial Reporting: Detailed financial statements are crucial for stakeholders to make informed decisions. Accountants prepare and analyze these reports.

- Risk Management: Understanding financial risk is essential. Accountants use various techniques to assess and mitigate risks.

The Role of Accountants in Financial Services

Accountants serve as the backbone of financial services, offering expertise that helps organizations thrive. Their responsibilities are multifaceted:

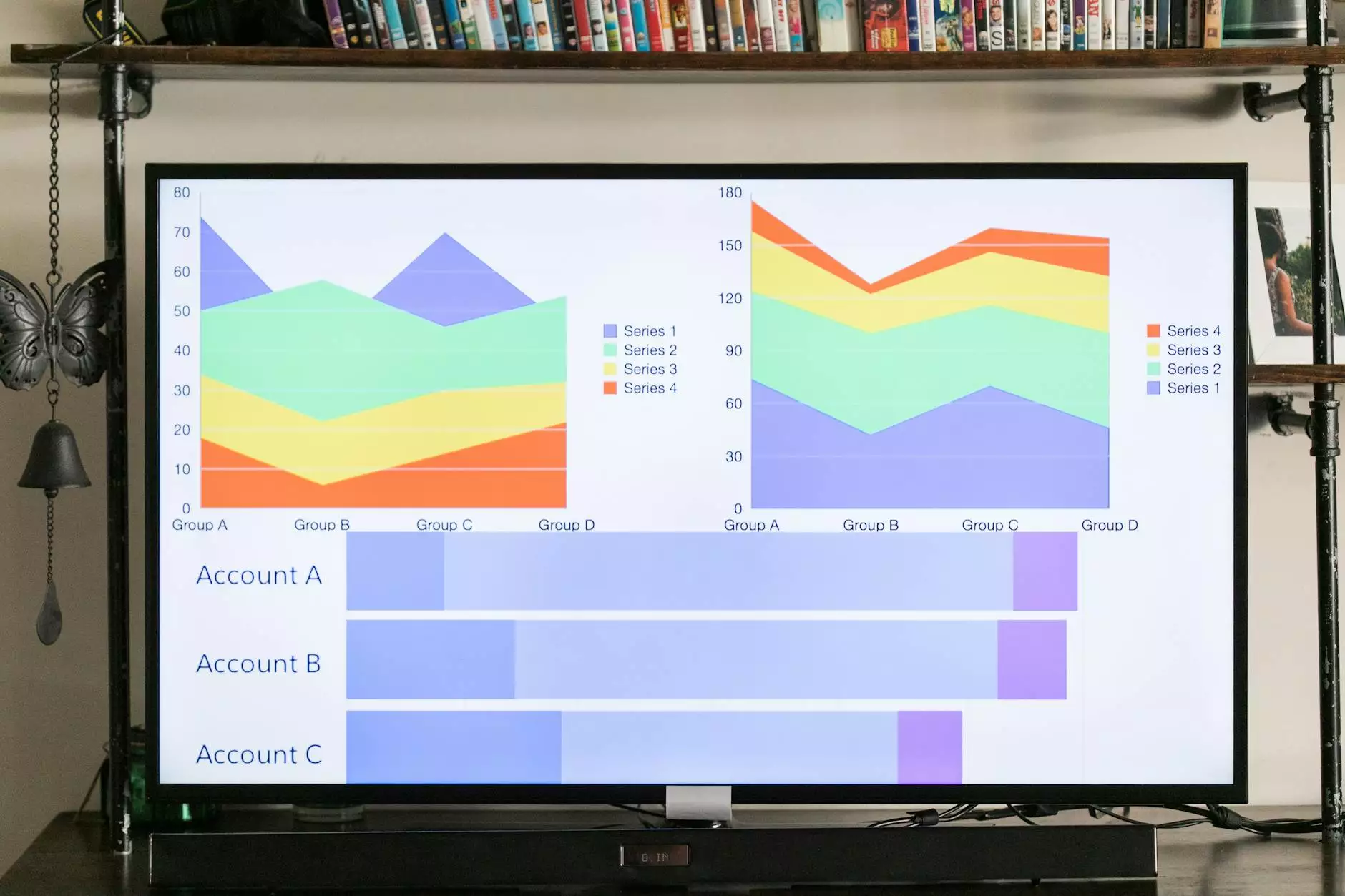

1. Financial Analysis

Accountants conduct rigorous financial analyses to provide insights into a company's performance. This includes:

- Budgeting: Assisting businesses in creating effective budgets that align with their financial goals.

- Forecasting: Projecting future revenues and expenses to prepare for financial fluctuations.

- Variance Analysis: Identifying differences between planned and actual performance, facilitating strategic adjustments.

2. Audit Services

Internal and external audits are critical for maintaining credibility and transparency in financial reporting. Accountants ensure that:

- Financial Statements: Are accurate and comply with GAAP or IFRS standards.

- Operational Efficiency: Processes are evaluated for efficiency and effectiveness.

- Fraud Prevention: Measures are in place to detect and prevent fraudulent activities.

Navigating Challenges in Financial Accounting

The landscape of accounting for financial services is fraught with challenges, from regulatory changes to evolving technological demands. Key challenges include:

1. Regulatory Compliance

Financial institutions are subject to strict regulations that are constantly evolving. Accountants must stay updated on these changes to ensure compliance. Failures in compliance can lead to severe penalties and damage to reputation.

2. Technology Integration

The rise of digital financial services and FinTech solutions has transformed traditional accounting practices. Accountants need to adapt to new technologies, such as:

- Blockchain: For enhanced transparency and security in transactions.

- Artificial Intelligence: For automating routine accounting tasks and improving accuracy.

- Cloud Computing: For real-time access to financial data and collaborative solutions.

3. Cybersecurity Risks

As financial services increasingly move online, the risk of cyberattacks grows. Accountants play a pivotal role in implementing robust cybersecurity measures to protect sensitive financial data.

Business Consulting: Enhancing Financial Service Operations

Beyond traditional accounting, business consulting plays a crucial role in the operational efficacy of financial services. Consultants help organizations optimize processes and enhance profitability through:

1. Strategic Planning

Consultants assist in developing long-term strategies that align financial goals with overall business objectives. Effective strategic planning involves:

- Market Analysis: Assessing market conditions and competitive landscapes.

- Goal Setting: Establishing clear, measurable objectives.

- Resource Allocation: Ensuring optimal use of financial and human resources.

2. Operational Improvements

Consultants identify inefficiencies in existing processes and recommend improvements. This includes:

- Process Mapping: Analyzing workflows to pinpoint bottlenecks.

- Cost Reduction Strategies: Implementing measures to lower expenses without sacrificing quality.

- Performance Metrics: Establishing key performance indicators (KPIs) to monitor progress.

3. Change Management

Implementing changes in financial services requires careful management to minimize disruption. Consultants help organizations navigate change through:

- Communication Strategies: Ensuring all stakeholders are informed and engaged.

- Training Programs: Providing necessary training for staff.

- Feedback Mechanisms: Establishing channels for feedback to gauge the effectiveness of changes.

Conclusion: The Future of Accounting for Financial Services

The world of financial services is continuously evolving, and with it, the role of accountants and business consultants. As we move forward, the integration of new technologies, stringent regulatory requirements, and the need for data integrity will shape the future landscape. By committing to excellence in accounting for financial services, professionals in this field will not only ensure compliance but also drive strategic decision-making that fosters growth and sustainability.

Ultimately, understanding the complexities and embracing the challenges in the accounting domain is essential for success in the highly competitive financial services sector. Businesses that prioritize robust financial practices and investing in qualified accountants and consultants will emerge as leaders, ready to navigate the dynamic marketplace with confidence.