Unlocking Business Success: A Complete Guide to Swing Trading for Beginners and Strategic Financial Growth

In today's dynamic economy, understanding the nuances of financial markets and business management can set you apart from the competition. Whether you are an aspiring entrepreneur, an investor looking to diversify, or a seasoned professional aiming to refine your strategies, mastering key concepts such as swing trading for beginners can significantly enhance your financial portfolio. At BullRush.com, we are dedicated to empowering you with the knowledge and tools necessary to thrive across different sectors including IT Services & Computer Repair, Financial Services, and Financial Advising. This comprehensive guide aims to shed light on how businesses can leverage swing trading strategies and sound financial practices for sustainable growth and profitability.

What Is Swing Trading and Why Is It Important for Modern Businesses?

Swing trading is a style of trading that aims to capitalize on short- to medium-term price movements in the financial markets. Unlike day trading that involves executing multiple trades within a single day, swing trading seeks to hold positions for several days or weeks, capturing price swings that occur during market fluctuations. For businesses engaging in financial strategies, understanding swing trading for beginners unlocks opportunities for additional revenue streams, risk management, and portfolio diversification.

This approach is especially relevant for companies involved in financial services and IT solutions that seek to optimize investment portfolios or hedge against market volatility. By integrating swing trading techniques, companies can not only bolster profit margins but also develop more robust financial frameworks capable of withstand market shocks.

Fundamental Principles of Swing Trading for Beginners: A Step-By-Step Approach

1. Market Analysis and Trend Identification

Successful swing trading begins with meticulous market analysis. Beginners should familiarize themselves with technical analysis tools such as candlestick charts, moving averages, and support/resistance levels. Identifying trends—whether upward, downward, or sideways—is crucial in determining entry and exit points for trades.

2. Selecting the Right Stocks and Assets

Choosing liquid assets with sufficient volatility is vital. Stocks, commodities, or currency pairs with predictable swings offer better opportunities. Beginners should prioritize assets that align with their risk appetite and capital investment plans.

3. Timing and Entry Strategies

Timing entries based on technical signals, such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence), enhances trading accuracy. The goal is to enter positions when the asset shows signs of reversal or continuation, optimizing the return on investment.

4. Managing Risk and Setting Stop-Losses

Effective risk management is the cornerstone of sustainable swing trading. Implementing stop-loss orders helps prevent significant losses. For beginners, setting stop-loss levels at strategic points—such as below recent support—can safeguard capital.

5. Exiting Trades and Profit Taking

Knowing when to exit is equally important. Profit targets are typically set based on expected swings, technical levels, or a predefined percentage gain. Discipline in executing exit strategies ensures consistent profitability and minimizes emotional decision-making.

How Swing Trading for Beginners Benefits Your Business and Investment Portfolio

- Enhanced Liquidity Management: A strategic approach to swing trading can provide steady cash flows, bolstering your business’s liquidity.

- Risk Diversification: Investing in different assets via swing trading mitigates risks associated with market downturns or sector-specific volatility.

- Additional Revenue Streams: Companies involved in financial services can generate supplementary income by actively participating in market swings.

- Strategic Data and Market Insights: Engaging in swing trading sharpens analytical skills, benefiting decision-making processes in broader business operations.

- Competitive Edge in Financial Markets: Mastery of swing trading strategies positions your business as a knowledgeable player in the financial ecosystem, attracting clients and investors alike.

Strategic Financial Planning to Complement Swing Trading & Business Growth

Effective financial advising and planning are essential for integrating swing trading into a comprehensive business strategy. Here are key elements to consider:

- Aligning Investment Goals: Clear objectives must be set concerning risk tolerance, expected returns, and time horizons.

- Utilizing Technology and Analytics: Modern tools for technical analysis and risk assessment enhance decision-making accuracy.

- Continuous Education and Market Monitoring: Staying informed about market trends, economic indicators, and global events ensures informed trade decisions.

- Collaborating with Experts: Partnering with financial advisors or IT service providers like BullRush.com can provide strategic support and technological solutions to automate and optimize trading processes.

Leverage Technology and IT Services for Optimal Business Financial Management

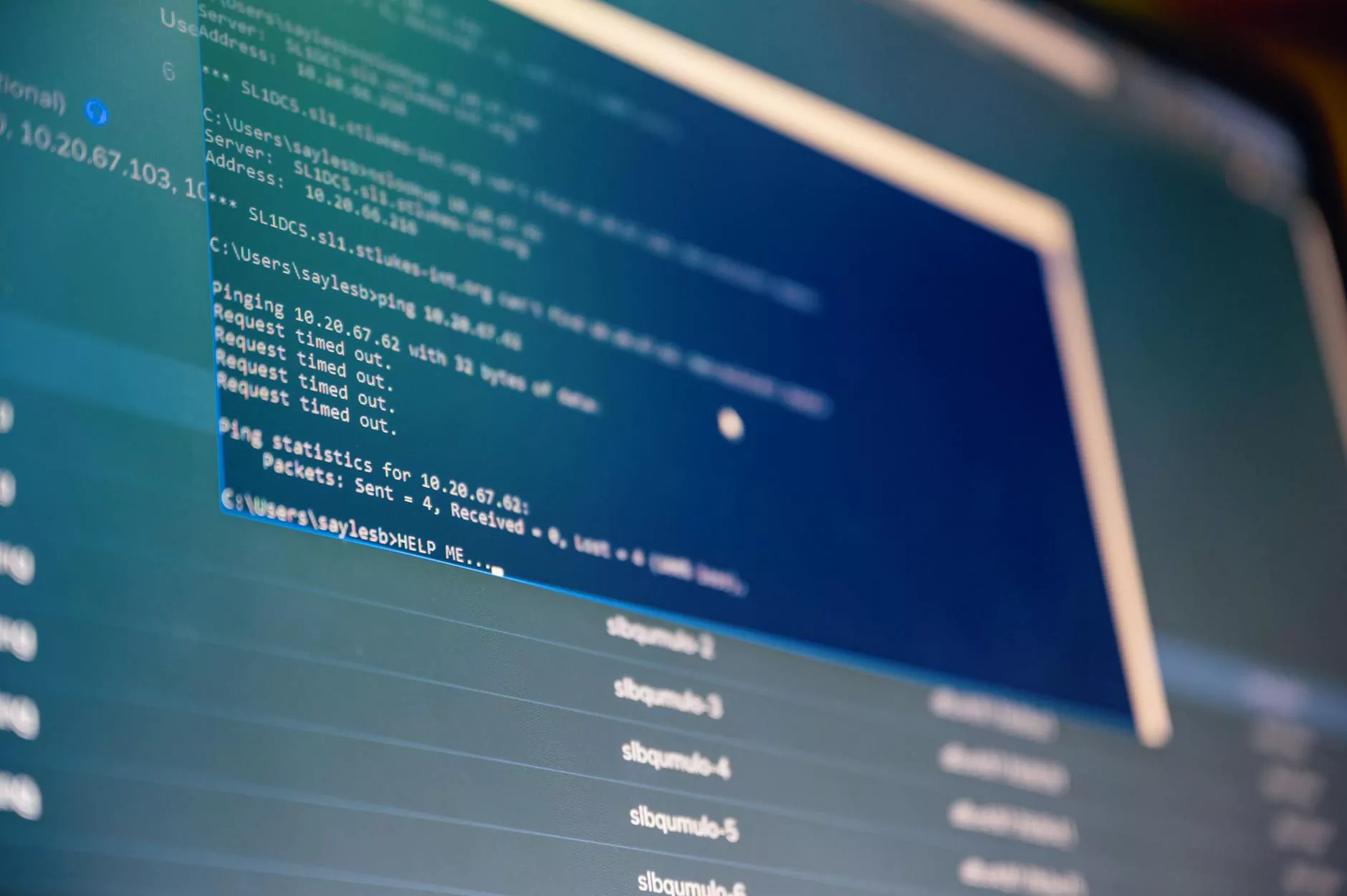

Incorporating innovative IT services & computer repair solutions can streamline financial operations, ensure system security, and enable real-time data analysis. Advanced software platforms facilitate swing trading by providing:

- Real-time market data feeds

- Automated trading algorithms

- Risk management tools

- Comprehensive portfolio tracking

Partnering with reliable IT service providers like BullRush.com ensures your business remains technologically competitive, secure, and agile in executing financial strategies rooted in swing trading for beginners.

Building a Sustainable Business with Long-Term Financial Security

Successful integration of swing trading is not just about immediate gains; it’s about creating a resilient business foundation. Here’s how to nurture long-term success:

- Consistent Learning and Strategy Refinement: Markets evolve, and so should your trading tactics.

- Balanced Portfolio Diversification: Combine swing trading with other investment methods like value investing and passive income strategies.

- Integrating Financial Advisory Expertise: Engage experts to align your financial goals with market opportunities, ensuring steady business growth.

- Focus on Customer and Market Insights: Understand your customer needs and adapt strategies accordingly for sustainable expansion.

Transform Your Business Future with Expert Guidance and Strategic Execution

In conclusion, mastering swing trading for beginners offers substantial advantages for businesses aiming to enhance their financial performance and market resilience. When combined with comprehensive financial planning, cutting-edge IT solutions, and expert advice from reputable partners like BullRush.com, your enterprise can navigate market uncertainties with confidence and capitalize on emerging opportunities.

Remember, the journey to financial success is continuous. Stay informed, adaptable, and strategic, and your business will thrive in even the most volatile markets.

Start today by integrating these insights, leveraging technology, and seeking professional advice to align your business growth with sound financial management principles.